This article was originally published in Propertyfinder Trends 2017, Vol 3.

Prices have continued to fall for the past 6 months, and have been falling consistently now for almost three and a half years, since peaking in mid-2014. In most parts of the UAE, property prices are now at early-2013 levels.

Price drops have been slow and gradual, with low, single-digit percentage points per quarter across most communities and segments. Rents held better than sale prices in the early parts

of the decline but the reverse has been true for the past 12 to 18 months. Certainly over the past six months rents are falling faster than sale prices.

Significant volumes of new and generally affordable stock continues to be handed over at a steady pace, though often at a slower pace than quoted. And there’s a lot more in the pipeline.

A sluggish oil sector has reduced employment and demand for rental accommodation across the region. This is felt most in Abu Dhabi but has a knock-on effect for the rest of the country. Dubai is far better diversified and far less reliant on the petrodollar, but population growth and rental demand is not keeping pace with new project handovers and the new supply is causing downward pressure on rents.

Despite regional and international political dramas, wars in Yemen and Syria, the fallout with Qatar, and a Trump presidency, UAE business sentiment is quite good and is improving. The local economy is humming along. Small to medium businesses are investing and taking on more staff, particularly in the tech sector. Construction and tourism continue to be strong.

GCC governments who are traditionally heavily reliant upon oil revenues have reassessed spending and taken big steps towards diversi cation. But this will take more time. No doubt they are

less buoyant than they’ve been historically. Yet driving around Dubai, anyone can see that infrastructure investment continues at breakneck speed.

Transactions are taking place. Lots in fact. But off-plan sales once again account for the bulk. This is a concern. But why are people buying off-plan in a falling market? There are several reasons:

The Mortgage Cap imposed by the Central Bank which stipu- lates that expats must pay a minimum of 25% deposit, plus up to 7% in transaction costs for completed property on their first purchase below ve million, 35% deposit plus costs (above ve million) and 40% deposit plus costs for any additional purchase. First announced on 31 December 2012, and formally implemented on 1 January 2014, many commentators have argued that this cap has achieved specifically what it was intended to achieve: a cooling in prices, and diversion away from the secondary market toward the primary market.

Increased competition amongst developers and a high volume of new project launches has resulted in aggressive low deposit and post-handover payment schemes designed to incentivise buyers in a falling market. This includes what could be called subprime buyers who cannot afford to buy in the secondary market due to the much larger deposits required.

Popular sentiment is that prices are at, or very close to, the bottom of the cycle and will increase in the lead-up to Expo 2020. They will also be in increase in product offerings in affordable emerging communities in the sub-one million AED, sub-one thousand AED per square foot segment, which were historically under-serviced during Dubai’s earlier construction booms.

Projects that have been handed over in 2017 or earlier were largely funded by front-ended payment schemes where the consumer generally paid more than 50% during construction. But off-plan sales that have taken place in 2016 and 2017 have been a very different story.

Deposits are low while commissions remain high. Agents can earn 3% to 4% on an off-plan buyer’s 10% deposit. Headlines often quote big sales volumes and the total sale price of a yet-to-be-built, and largely yet-to-be-paid-for property.

While far better regulation now exists to ensure that progress payments are linked to construction milestones and that buyer funds are held securely in escrow, a few of these too good to be true payment plans may prove to be just that.

Yet in other parts of the market, well-located villas in some of Dubai’s most sought-after established communities are now within reach of the common man. Few global cities offer the opportunity to buy a well built four bedroom free-standing villa in prime location on a decent sized block for under $1.2 million. Try doing that in London, Sydney, New York, Paris, or Geneva. Good luck. But you can in Dubai.

Long-term residents are taking advantage, snapping up good deals, planting roots, and swapping their rent cheques for a mortgage.

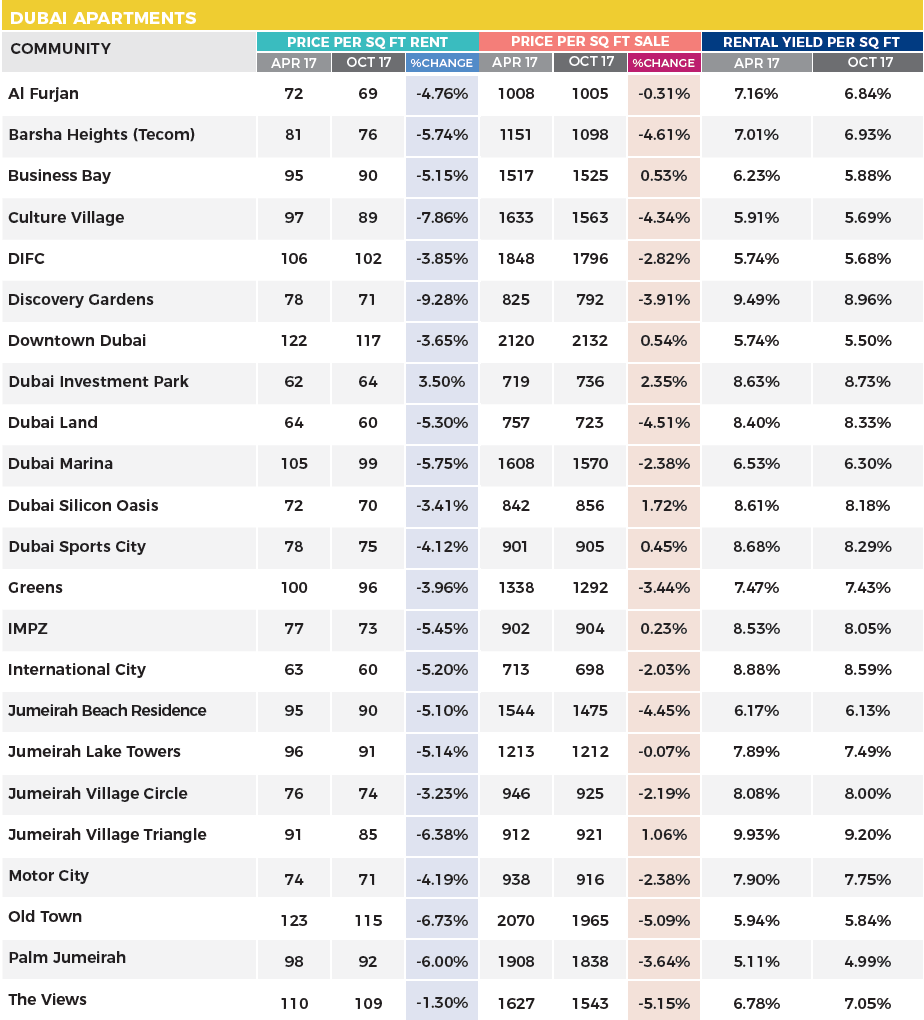

DUBAI APARTMENTS FOR RENT

Rents in Dubai have fallen, with a median price per square foot of AED 89. While a few communities have witnessed modest increases, the majority have seen low single-digit percentage declines in asking prices over the past 6 months.

This can be directly attributable to the level of new stock being handed over. Many of these developments were sold to investors, some of whom had hoped to make a capital gain and flip (on- sell) at, or prior to, completion. But a falling market has converted these speculators into buy to let investors. This affects not only the development itself but surrounding areas and rents within new and established projects in similar price points.

The biggest drop was in Discovery Gardens, which saw a big 9.3% decline in median asking rents. Historically one of the most affordable developments in Dubai, it is facing increasing competition from new “affordable” projects across Dubai.

Dubai Investment Park is the only area to buck the downward trend, going up in price by 3.5%. It is now no longer the city’s most affordable place to rent, that title now belongs to Dubai Land at AED 60 per square foot.

Downtown Dubai, despite a decline in asking rents, is still the most expensive community to rent (AED 117 per sq ft), slightly more expensive than Old Town (AED 115 per sq ft). International City and Dubai Land are the two cheapest communities in which to rent in Dubai. Both at AED 60 per square foot.

DUBAI APARTMENTS FOR SALE

Sale prices have also been falling with low, single-digit declines across most communities in Dubai. The biggest drop was in The Views (-5.2%), but it still commands quite a high price per sq foot at AED 1,543. Dubai Marina saw a more modest 2.4% decline. Business Bay went against trend with an increase in sale price (up 0.5%), perhaps boosted by the completion of Dubai Canal.

Affordable areas such as Dubai Investment Park (+2.5%) Dubai Silicon Oasis (+1.7%), Dubai Sports City (+0.4%) IPMZ (+0.2%), and Jumeirah Village Triangle (+1%) all saw modest increases indicating that demand remains reasonably strong in this segment. International City is still the cheapest to buy with median asking prices of just AED 698 per square foot.

RENTAL YIELD PER SQUARE FOOT – DUBAI APARTMENTS

Rents in Dubai for apartments are falling faster than sale prices, so yields are declining but still remain very strong and are amongst the best in the world. JVT tops the list with an impressive 9.2%. Discovery Gardens, Dubai Investment Park, Dubai Silicon Oasis, and Dubai Sports City all achieved over 8%. Dubai’s blue-chip communities; Palm Jumeirah and Downtown Dubai ironically have the lowest yields, at 5% and 5.5% respectively.

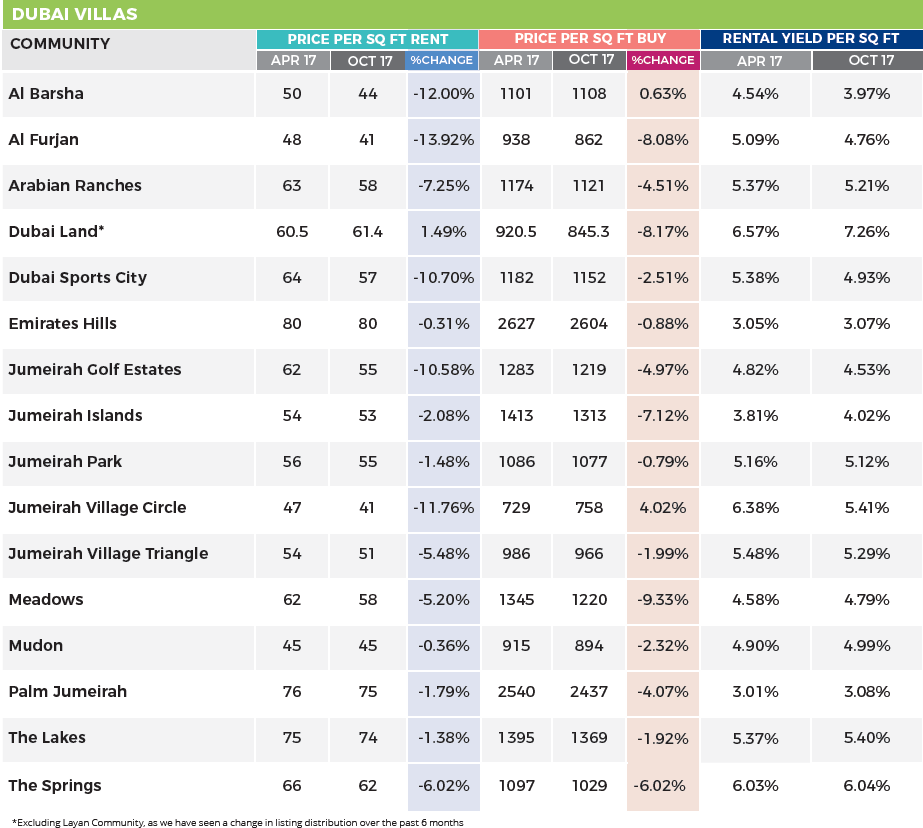

DUBAI VILLAS FOR RENT

It’s a good time to rent a villa in Dubai. Dubai villa rents have witnessed the biggest decline of all the categories assessed in this report. Some of Dubai’s most popular villa communities have seen double-digit declines over the past six months. The biggest drop was in Al Furjan (-13.9%) followed by Al Barsha (-12%), JVC (-11.8%), Dubai Sports City (-10.7%), Jumeirah Golf Estates (-10.6%) and Arabian Ranches (-7.3%). Most of these communities experiencing large handover of stock directly within or in surrounding communities.

Villa rental asking prices in Emirates Hills(-0.3%),Jumeirah Islands (-2%), and Jumeirah Park (-1.5%) have remained relatively stable. Dubai Land (+1.5%) and Al Barsha (+0.6%) were the only Dubai villa communities to experience an increase in their median asking price in the last six months.

In terms of value for money, Al Furjan and JVC, both at AED 41 per square foot, are the cheapest places to rent a villa in Dubai. While Emirates Hills (AED 80 per square foot) and Palm Jumeirah (AED 75 per square foot) are the most expensive.

DUBAI VILLAS FOR SALE

Dubai villa sale prices also experienced significant declines. Surprisingly, Meadows (-9.3%), one of Dubai’s best and most sought-after Emaar-built villa communities experienced the biggest decline over the past six months. Dubai Land (-8.2%), Al Furjan (-8.1%), and Jumeirah Islands (-7.1%) were the other big movers.

Villa sale prices in Emirates Hills and Jumeirah Park remained stable, while JVC (+4%) and Al Barsha (+0.6%) were the only two villa communities that witnessed an increase in the past six months..

At AED 758 per square foot, JVC is Dubai’s most affordable villa community to buy, and one of the few that has experienced a price increase, indicating that demand remains healthy in the affordable villa segment. A square foot costs 243% more in Emirates Hills and 221% more in Palm Jumeirah, which remain Dubai’s most expensive villa communities.

RENTAL YIELD PER SQUARE FOOT – DUBAI VILLAS

For investors, Dubai Land (7.3%) offers Dubai’s best rental yield in the villa segment. Followed by The Springs, which, despite significant declines still offers a very healthy 6%. Arabian Ranches, Dubai’s most searched villa maintains a decent 5% rental yield.

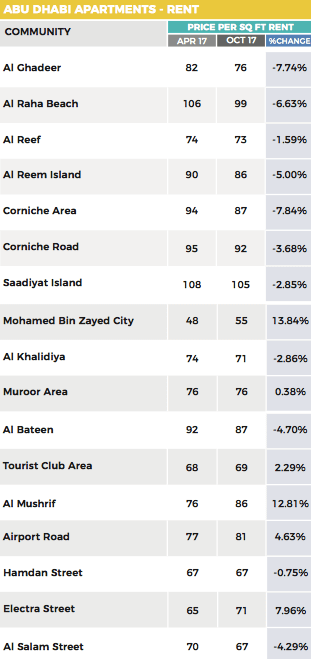

ABU DHABI APARTMENTS FOR RENT

Abu Dhabi apartments for rent are a tale of two cities, with almost half the tracked apartment communities experiencing increases in their asking rents over the past six months.

Mohamed Bin Zayed City (+13.8%), Al Mushrif (+12.8%), and Electra St (+8%) all saw statistically large increases. All are non-freehold and relatively affordable communities with limited stock, so these rises in the median asking price shouldn’t be read as a market recovery.

MBZ City is Abu Dhabi’s most affordable apartment community where asking rents are just AED 55 per square foot. Al Mushrif is full of large villas, some have recently been converted into studios and 1 bed apartments as landlords re-evaluate their leasing strategies.

Meanwhile, rents dropped in Corniche Area (-7.8%), Al Ghadeer (-7.7%), Al Raha Beach (-6.6%), Al Reem Island (-5%), and Al Bateen (-4.7%), which is more in line with trends across the rest of the country.

Despite a decline of 2.8%, Saadiyat Island remains the most expensive place to rent an apartment in Abu Dhabi at AED 105 per square foot followed by Al Raha Beach (AED 99 per square foot)

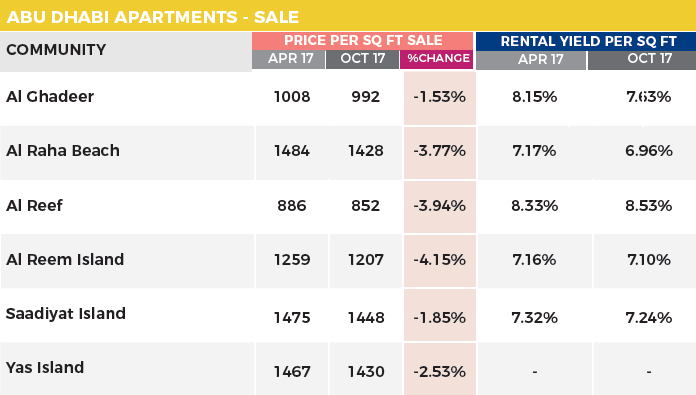

RENTAL YIELD PER SQUARE FOOT – ABU DHABI APARTMENTS

For landlords and investors willing to take a plunge into a falling market, rental yields in Abu Dhabi are still very good, ranging from 7 to 8% across all communities

Abu Dhabi apartments for rent are a tale of two cities, with almost half the tracked apartment communities experiencing increases in their asking rents over the past six months.

GCC governments who are traditionally heavily reliant upon oil revenues have reassessed spending and taken big steps towards Dubai apartment diversification. But this will take more time. No doubt they are less buoyant than they’ve been historically. Yet driving around Dubai, anyone can see that infrastructure investment continues at breakneck speed.

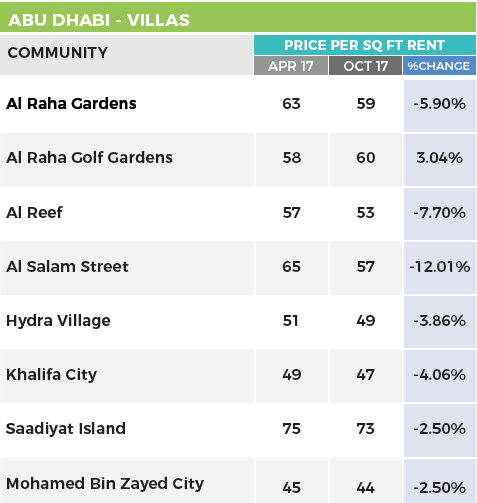

ABU DHABI VILLAS FOR RENT

Asking prices for Abu Dhabi villas continue to decline with Al Salam Street (-12%), Al Reef (-7.7%), and Al Raha Gardens (-5.9%) seeing the biggest falls in the last six months. Others seeing low, single-digit declines are Al Raha Golf Gardens (+3%), which was the only villa community to see an increase in asking rents.

Mohamed Bin Zayed City (AED 44 per square foot) remains the cheapest place to rent a villa in Abu Dhabi, with Khalifa City (AED 47 per square foot), and Hydra Village (AED 49 per square foot) not far behind. By far the most expensive is Saadiyat Island, asking AED 73 per square foot.

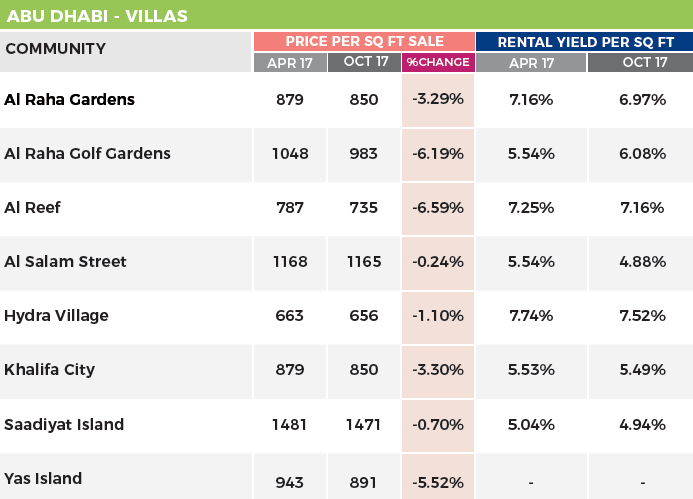

ABU DHABI VILLAS FOR SALE

Similarly, villas for sale in Abu Dhabi have also witnessed low to mid single-digit declines over the last six months with the biggest drops are in Al Reef (-6.6%) and Al Raha Golf Gardens (-6.2%).

Hydra Village is still the most affordable, with asking price median at AED 656 per square foot and Saadiyat Island the most expensive at AED 1471 per square foot.

RENTAL YIELD PER SQUARE FOOT – ABU DHABI VILLAS

Yields remain stable in the capital for villas, and in general are better than on offer in Dubai with affordable villas in Hydra Village offering the best yield at a very healthy 7.5% per annum.

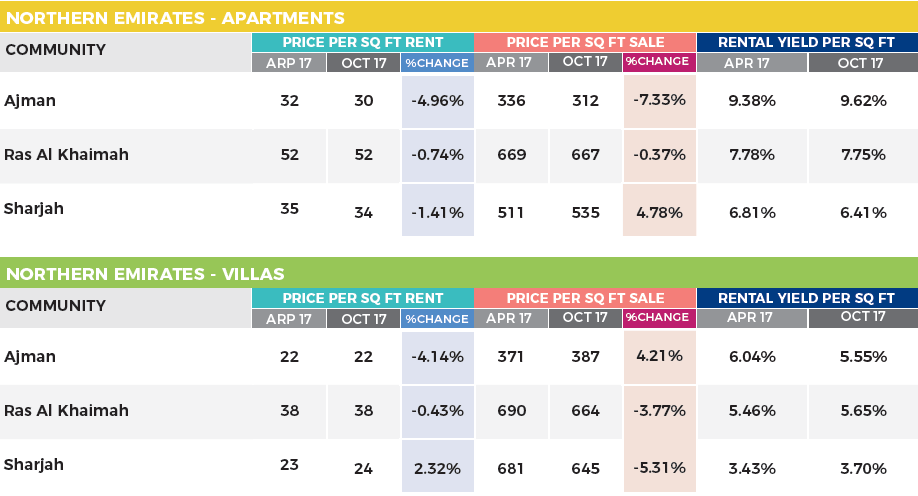

THE NORTHERN EMIRATES

Ajman is the cheapest place to rent an apartment in the UAE, with apartment prices asking just AED 30 per square foot and AED 22 per square foot for villas; marginally more affordable than Sharjah (apartments asking AED 34 per square foot and AED 24 per square foot for villas).

Ajman also offers the best rental yields for apartments in UAE with a world-leading 9.6% per annum.

RAK, whose prices both for sale and rent remained stable over the last six months, is the most expensive option of the Northern Emirates.

Click here to read the full report online (Adobe Flash required) or click here to download the PDF. To request a printed copy, drop us a line at marketing@propertyfinder.ae