Is it cheaper to rent or buy your home? Property Finder has created a free tool that will help you calculate the answer.

Renting is often described as ‘throwing money away’ but this isn’t always true. Our new Rent vs Buy Calculator compares your current rental expenses to the cost of buying a property while factoring in the number of years you plan to stay in the UAE. You can then decide which makes more financial sense for you in the long run.

Lynnette Abad, Director of Research and Data at Property Finder Group, says the new free tool was designed to solve a frustration she had when she was considering buying a property herself last year.

I wanted to see a breakdown and analysis of costs to know how much I would save in the long run if I were to buy, and my bank couldn’t provide me this,” says Abad. “Being in the industry, I was able to work out the analysis myself, but a consumer would struggle to get all of this information and do the math.

So, how does it work?

The Rent vs Buy Calculator lets you enter your monthly rent, the price of the property you are interested in and the number of years you plan on living in the property, automatically calculating the minimum required down payment*. Factoring in additional fees such as Land Department fees, it provides a simple breakdown of the estimated costs. It then analyses all this data to show the breakeven point where buying becomes a better option than renting.

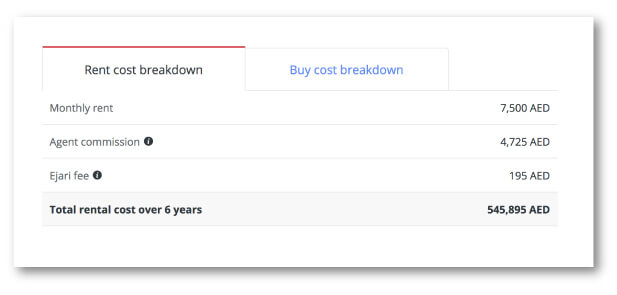

Cost of Renting

The calculator includes additional rental costs such as agent commission fees (one-time fee of 5% yearly rent + VAT) and the yearly Ejari fees on top of the monthly rent amount.

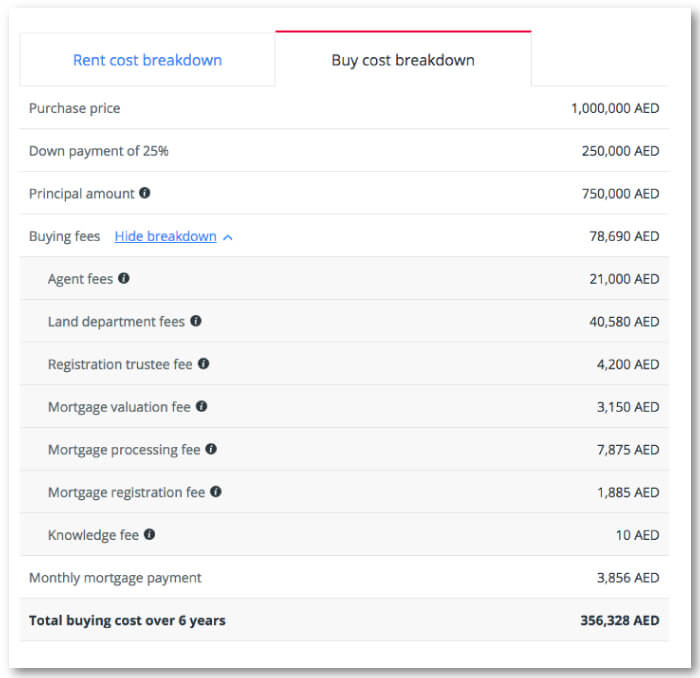

Cost of Buying

In addition to the price of the property, the Rent vs Buy Calculator takes into account the minimum down payment* amount and the various fees involved; the monthly mortgage payment, agent’s commission, Dubai Land Department registration, Registration Trustee fees, property valuation fee, mortgage processing and registration fees. Also included are the mortgage interest rate and mortgage loan period.

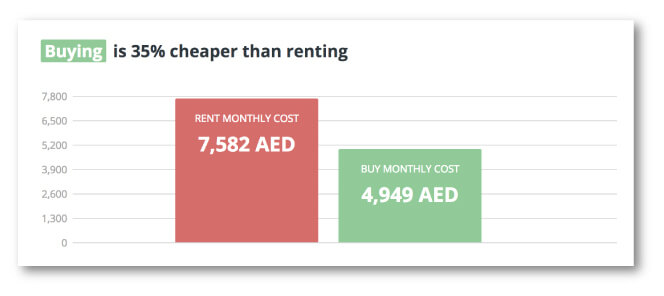

In our example, a resident considering a property of AED 1 million who expects to stay in the UAE for 6 years and currently pays AED 90k in rent would find it cheaper to buy in the long run.

Put your own figures into our easy-to-use tool and watch it analyse your details. You might be surprised to learn that over a few years, a monthly mortgage payment would be much less than what you pay in rent each month — Try it now!

*Please note: As per the UAE Central Bank, an expatriate homeowner is required to put down a minimum of 25% of the property’s value as a down payment.