Financing your property investment is one of the key elements to keep in mind when entering the real estate market in Dubai. Most fresh players in the industry take out a mortgage to pay off their purchase, however, some regulations can be a little confusing at first. propertyfinder.ae summs up the main provisions of Dubai’s mortgage law.

Mortgage Law

Law No (9) of 2009 came into action to amend certain provisions of Law No (13) of 2008, regulating the interim real estate register in the emirate of Dubai, otherwise known as “Mortgage Law”. The main foundations of the law are as follows:

Definitions (Articles 3-6): define standard terms such as mortgage, mortgagee and mortgagor.

- Registration of a Mortgage (Article 7): A Mortgage is not valid unless it is registered with the Department and any agreement to the contrary is void. Also, the Mortgagor i.e the Owner of the property, shall bear the costs of the contract unless otherwise agreed. The costs of registering a mortgage is a fee of 0.25% of the loan amount plus AED 4,100.

- Mortgage Application Procedure for RERA: outlines all the particulars that must be accompanied along with a mortgage application so that it can be registered.

- Legal Effects of a Mortgage (Articles 10-20): These lay out the rights and restrictions of both the mortgagor and the mortgagee during the period of the mortgage.

Execution Proceedings on the Mortgaged Property (Articles 25-30): Clearly outlines instructions on how a mortgagee may commence proceedings against a mortgagor if it is found that the mortgagor is in default in this payments. The law calls for the property to be sold at a public auction after all the requisite procedures and notice periods have been met.

Loan-to-value ratios

At the end of October 2013 the Central Bank of the UAE issued a new set of regulations on mortgage lending to banks and other financial institutions. These regulations stated that the aim of the Central Bank is to ensure that banks, finance companies and other financial institutions providing mortgage loans do so in accordance with best practice and have control frameworks in place.

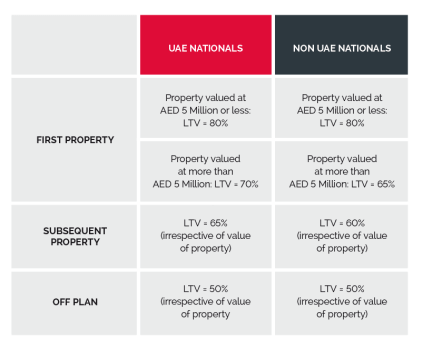

The below table shows the LTV ratios set by the mortgage regulations (the only current exception to the below LTVs are in the case of loans to UAE nationals under Government Housing Programmes):

Note: under Central bank laws, no more than 50% of your total income should be committed to paying off your debts including mortgage payments, credit cards, other loans etc. That’s why it is advisable to carefully examine your financial situation before applying for a mortgage.

Interest rates

There are two types of mortgages when it comes to payment rates:

– Fixed Rate Mortgages

Fixed rate mortgages have a fixed interest rate for the term of the mortgage; this rate is determined prior to signing the mortgage offer letter and is generally offered for a period of one, two, three or five years, although some lenders might offer a fixed interest rate for the entire term of the loan. Advantages of this type are:

- Ability to find a clear budget since you know that mortgage rates won’t change for the agreed period of time.

- Locking in a fixed rate of interest in case mortgage rates rise in the future.

- Knowing how much you will be paying each month.

– Variable Rate Mortgages

Variable interest rate mortgages are those in which the interest rate is dependent on market factors and can change at any time during the loan term. This works if:

- Interest rates might stabilize or decrease.

- You have the financial flexibility and stability to handle changing mortgage rates.

mortgagefinder.ae

Many applicants make the mistake of going straight to their banks for mortgage loans; however they might be missing out on better deals that can be obtained by doing a little research. Using a mortgage broker not only saves you time, but it gives you a helping hand throughout the entire process of obtaining a loan. mortgagefinder.ae offers loans and mortgages on both property purchases and rent. Find out more how you can begin investing in properties with the help of mortgagefinder.ae.

Mortgage Cap

Here is some information you need to know about the UAE Mortgage Cap:

- The Mortgage Cap was first announced in December 2012 as speculators began seriously ramping up UAE property prices.

- For expats, it capped mortgages to 75% of the valuation for a first purchase and 80% for UAE nationals.

- Loans above AED5million are capped further, 65% for expats.

- If you want to buy a villa in Dubai in the AED5m – 10m you need almost 50% of the price in cash.

Begin viewing thousands of properties for sale in Dubai starting from 300,000AED