The pros and cons of investing in Dubai’s off-plan and secondary property markets.

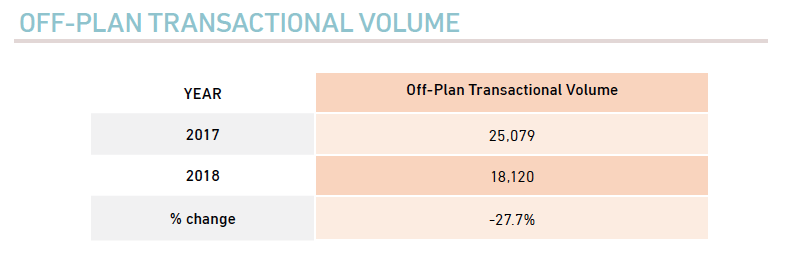

A real estate investor often struggles with deciding between primary (off-plan) investments versus secondary (resale) investments. This difficult choice becomes compounded in growing markets where primary sales are a significant portion of the volumes, as opposed to economies where the majority of the volumes are in the secondary space due to few new developments. For example, a market like Dubai has significantly geared towards primary sales in the last three years.

A larger number of primary transactions is usually a sign of vibrant economic activity as it indicates new developments are required for the demand of a growing city, which could be led by either better job prospects – as is the case with Dubai (shown in the chart below) – or increasing urbanisation in a country such as India.

Similarly, a healthy secondary market is also required as it is a sign of a balanced supply and demand market.

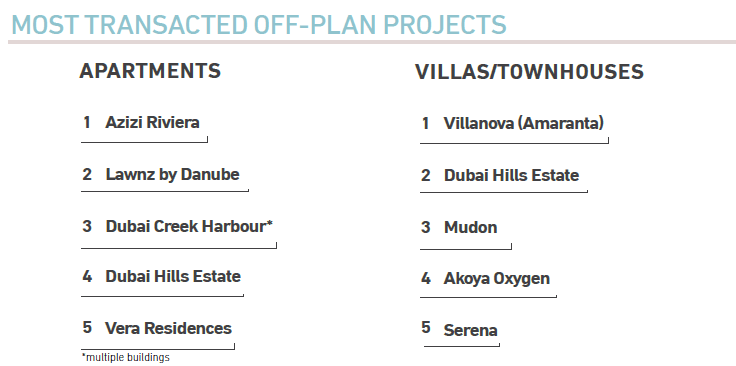

Apart from the greater share of primary transactions, the current Dubai market can also be characterised along the following parameters:

- Stable rental yields

- Significant new launches

- New catchment areas being developed for future growth

- Post-possession payment plans

- Aggressive offers in price by developers

- DLD waivers, free property management services

- Secondary market prices trading at a discount to primary market

In a healthy property market, there should be a minimal price difference between the primary and secondary segments; however, aggressive offers available in the primary market indicates a weaker demand as compared to supply, making the current Dubai scenario a buyers’ market. The following are the key characteristics of both primary and secondary investments:

- Equity outflow is staggered in the primary market, making it relatively easy on affordability and budgets

- The secondary market, however, adds the component of rental yields to the overall returns, and rental yields in Dubai are equal to or exceed mortgage rates (cost of capital)

- Since equity outflow is staggered in the primary market, capital appreciation may give a much higher ROE (Return on Equity) as compared to the secondary market

- Multiple developer offers can make primary transactions cheaper than the secondary counterparts (i.e. DLD waivers)

Primary market purchases are easier to research due to significant data available on similar transactions in the same catchment area (as it’s a homogenous product), while secondary market transaction research needs significantly more data-points in a particular hyperlocal market.

A buyer does not pay brokerage fees on primary market purchases, whilst in secondary market

Both primary and secondary investments have their pros and cons, and the decision should be a function of multiple factors such

We believe that in the current scenario, investing in the primary market in Dubai is far more lucrative due to factors such as staggered payment plans, and discounts, which should result in much higher returns for the investor, as shown below.

________

Off-plan vs. Ready Property: The Age Old Question — Safura Abasniya

Property 101: Guide to Buying in Dubai

Will UAE stimulus efforts encourage expats to stay and buy?

________

RABIAH SHAIKH

Principal Partner

Square Yards

How many years’ experience do you have in real estate & market specialty?

I hold over 15 years of experience in the real estate industry across various markets such as the UK, Canada, Singapore, Hong Kong and the UAE.

What’s your educational background?

I hold an MBA in International Business Management.

Why did you write on the benefits of investing in off-plan?

As Square Yards is one of the largest players in the Dubai primary market, we wish to educate clients on the benefits of investing in off-plan, in the current market scenario.

In just a few words, describe the UAE real estate market in 2019.

We expect softness in the real estate market to continue into 2019. 2018 has seen a reduction in rentals led by strong supply and a much needed healthy correction in yields, both of which will remain factors this year as well.

This article was originally published in Property Finder Trends, Vol 5. Download the full report below to see detailed sales transaction data.