The New Year is days away, but there’s one thing you might not be throwing any confetti for: the introduction of VAT. Not to worry, we want to cover your questions about how VAT will impact your business, and your work with Propertyfinder, so it can be a carefree new year. Here we go!

Value Added Tax (VAT) will take effect in the United Arab Emirates from 1 January 2018. From then, Propertyfinder will be required to charge 5% VAT on all of our invoices as set forth by the Government’s regulations.

VAT due as a result of any new contract beginning January 2018, will be reflected as a separate line item on the invoice, and shall be payable to Propertyfinder FZ-LLC.

We volleyed some frequently asked questions at our in-house counsel, Brian Dunn. He has been working tirelessly to sort out what VAT means for our clients with tax consultants and our finance team. Here are his answers:

Q: My contract started in 2017, why are you charging me for VAT?

A: The effective Date of the VAT Decree-Law is 1st January 2018 and applies to all services provided as of January 2018. This means all services extending into 2018, since the service is being provided (for example, publishing of advertisement), VAT will be applicable.

Q: My business is exempt from VAT, why are you charging me 5%?

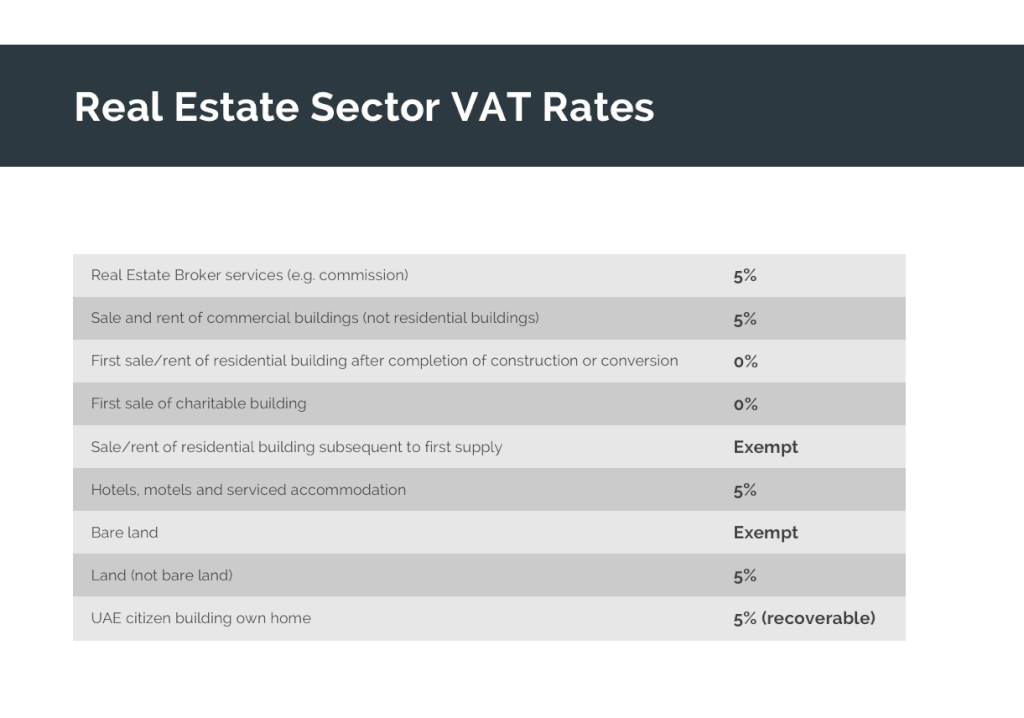

A: 5% VAT applies to ALL service transactions. Propertyfinder is a service, wouldn’t you agree? For Real Estate generally, below is a table of VAT rates.

Q: I am not registered for VAT, why should I pay Propertyfinder 5%?

As a business, Propertyfinder is bound by the law to pay 5% VAT on service provided to all our clients, regardless if the client opts to register or not with the Federal Tax Authority.

In order to implement VAT on our side and allow you, where possible, to reclaim the chargeable VAT from our services, we kindly request that you share your VAT registration certificate with us, or inform us in writing that you will not be a VAT registered company pursuant to the legislation no later than 15 January 2018.

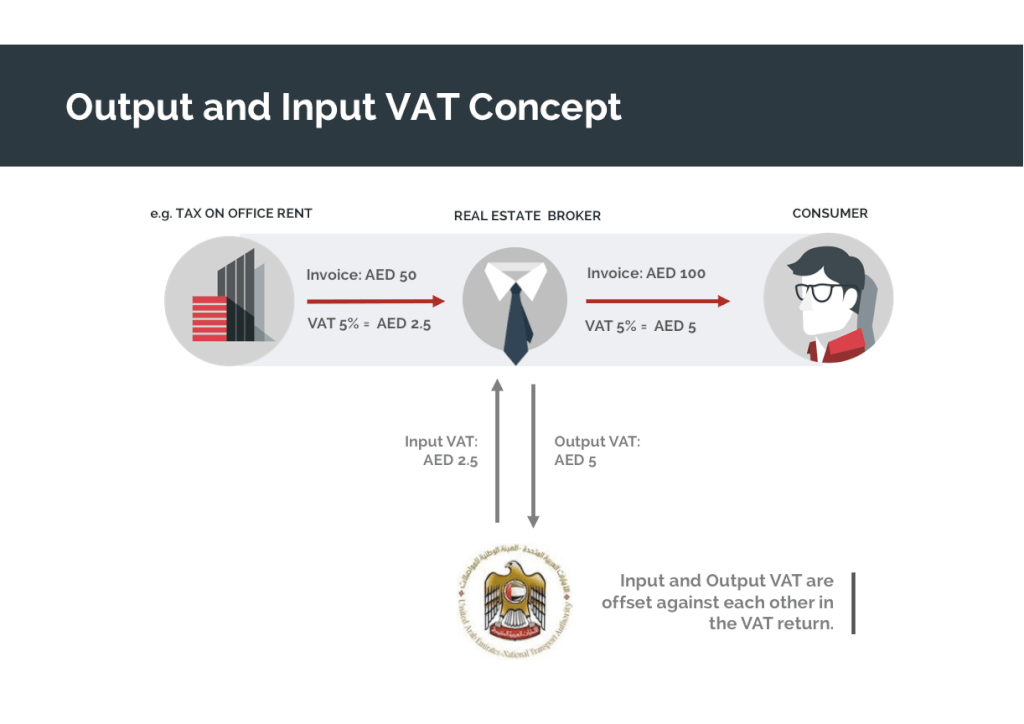

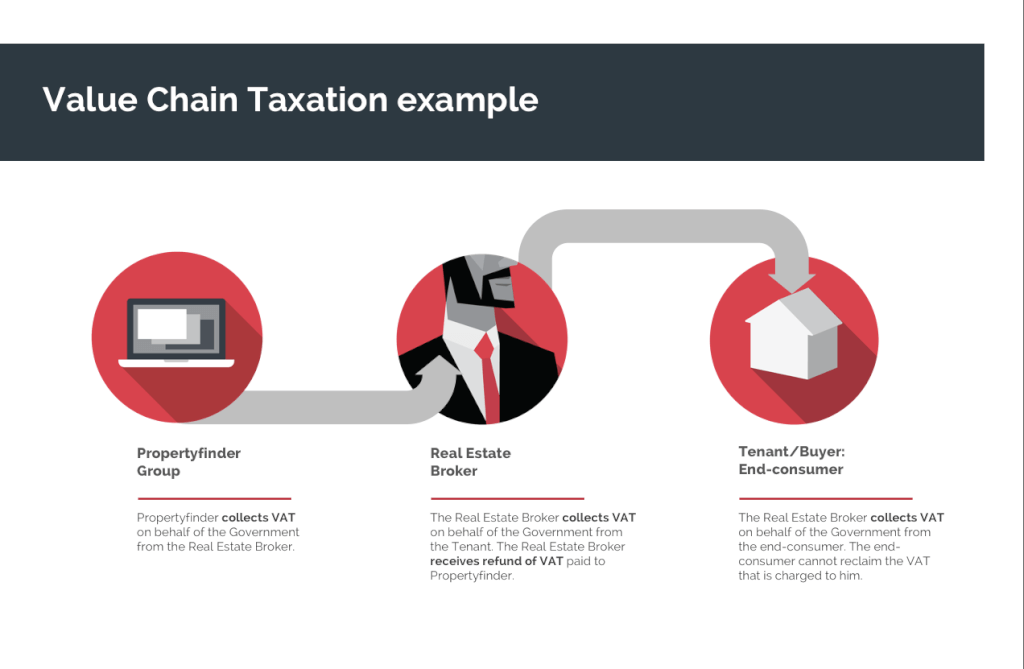

Here’s a visualisation of VAT in action:

To register, go to eservices.tax.gov.ae/en-us/signup – free of charge.

Kindly share with us your VAT registration number via email to Accounts no later than 15 January 2018.

That’s it! Any questions, please email your Account Manager.

Happy New (Tax) Year. Together, we can make VAT work for all of us.

—

Propertyfinder does not provide tax, legal or accounting advice. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. Propertyfinder advises you to consult your own tax, legal and accounting advisors before engaging in any course of action.