The UAE real estate market continues to evolve and the newly released Market Watch Digest for Q1 2025 offers a comprehensive overview of the latest developments.

Covering both the off-plan and ready-to-move segments, the report provides key insights and emerging trends from major markets including Abu Dhabi and Dubai. Whether you’re an investor, homeowner or industry professional, this digest delivers valuable data to help inform your next move.

Abu Dhabi Market Overview

While Abu Dhabi’s real estate market softened in Q1 2025, mainly due to a sharp drop in off-plan activity, steady demand in the ready segment points to a maturing, end-user-driven market. The following breakdown highlights key metrics and emerging trends shaping the capital’s evolving real estate landscape:

- In Q1 2025, Abu Dhabi’s real estate market experienced a notable slowdown, with total sales transactions declining by 35% in volume and 24% in value year-on-year.

- The drop was mainly driven by off-plan sales, which fell by 52% in volume and 50% in value, likely due to fewer new project launches.

- In contrast, secondary market transactions performed strongly, with a 75% increase in value and a 9% rise in volume. The value-to-volume gap is likely due to a few high-value commercial deals.

- The ready residential market remained resilient, with a 33% increase in transaction value and a 5% rise in volume, suggesting sustained demand and potential price pressure.

Total Sales Transactions

- Abu Dhabi saw a sharp decline in residential and commercial sales transactions in Q1 2025.

- Total volume of transactions fell to 2,496 from 3,857 in Q1 2024, marking a 35% year-on-year drop.

- Transaction value also declined by 24%, from AED 12.56 billion to AED 9.6 billion.

- This overall slowdown was primarily driven by a significant drop in residential activity, which accounted for 66% of the total volume and 57% of the total value.

Total Sales Transactions at a Glance

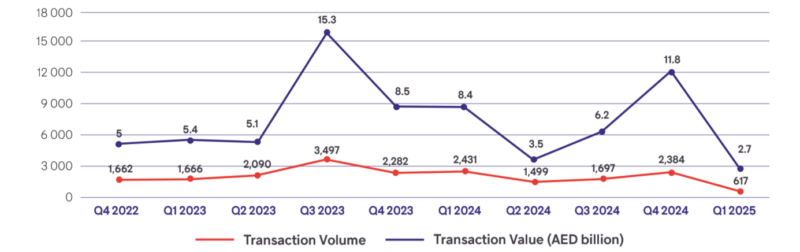

Off-Plan Sales Transactions

- Off-plan sales fell by 52% year-on-year to 1,332 transactions, down from 2,791 in Q1 2024.

- Transaction value also dropped by 50%, from AED 9.9 billion to AED 4.9 billion.

- Despite the slowdown, off-plan deals still accounted for 53% of total transactions in the quarter.

- Residential off-plan made up 46% of off-plan activity (617 transactions), while the remaining 54% were commercial or other asset types.

- Residential off-plan transactions saw a sharp decline of 75% in volume and 68% in value, totaling AED 2.7 billion, compared to AED 8.5 billion a year earlier.

- The downturn was largely driven by fewer project launches and seasonal factors such as Ramadan, during which developers offered promotions to sustain demand.

Historical Residential Off-Plan Transactions Performance

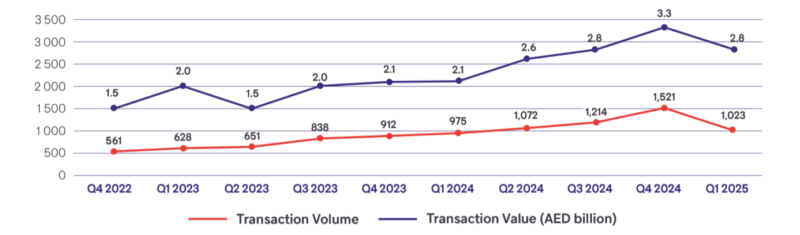

Ready Sales Transactions

- In Q1 2025, a total of 1,164 ready sales transactions were recorded, accounting for 47% of overall market activity, up 9% from 1,066 in Q1 2024.

- The segment contributed 49% of the total transaction value, with a sharp 76% year-on-year increase.

- Residential ready properties accounted for 88% of transaction volume and 60% of the total value within this segment (total ready transactions).

- Compared to Q1 2024, residential ready transactions rose 5% in volume and 33% in value, reflecting continued demand for move-in-ready homes.

Historical Residential Ready Transactions Performance

Dubai Market Overview

Dubai’s real estate market sustained strong growth in Q1 2025, as both the ready and off-plan segments posted their strongest first-quarter performance in a decade – driven by end-user demand and investor confidence. The following breakdown highlights the key trends behind this momentum:

- Dubai’s real estate market maintained strong growth in Q1 2025, with total transactions rising 22% year-on-year to 45,474 deals.

- Transaction value also increased by 30%, reaching AED 142.7 billion, driven by sustained demand across both off-plan and ready segments.

- Dubai’s ready property segment hit record highs in Q1 2025, with 20,034 transactions totaling AED 87.5B – up 21% in volume and 34% in value year-on-year – driven by a growing shift from renting to owning amid rising rental prices.

- Off-plan properties remained strong in Q1 2025, with a 24% year-on-year increase in both volume and value, reaching 25,440 transactions worth AED 55.2 billion – underscoring sustained investor confidence in Dubai’s long-term market potential.

Total Sales Transactions

- Dubai’s real estate market remained among the world’s top performers in Q1 2025, with strong growth in sales activity.

- Transaction volume reached 45,474, up 22% year-on-year, while total value rose 30% to AED 142.7 bn.

- Q1 outperformed the 2024 quarterly average in both volume and value.

- Notably, total deal value was 9% higher than the average quarterly value last year, reflecting continued market strength and investor confidence.

Total Sales Transactions at a Glance

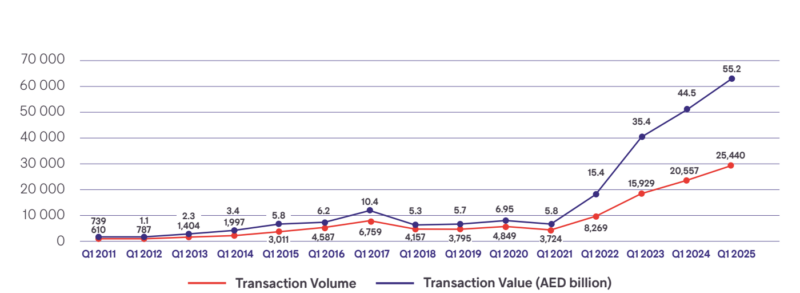

Off-Plan Sales Transactions

- Dubai’s off-plan market delivered its strongest first-quarter performance in a decade in Q1 2025.

- Off-plan sales reached 25,440, up 24% from 20,557 in Q1 2024, driven by strong long-term confidence from both mid-level and seasoned investors.

- Transaction value also rose 24% year-on-year to AED 55.2 bn, compared to AED 44.5 bn in Q1 2024.

- Off-plan deals accounted for 56% of total transaction volume and 39% of total transaction value in Q1 2025.

Historical Off-Plan Transactions Performance

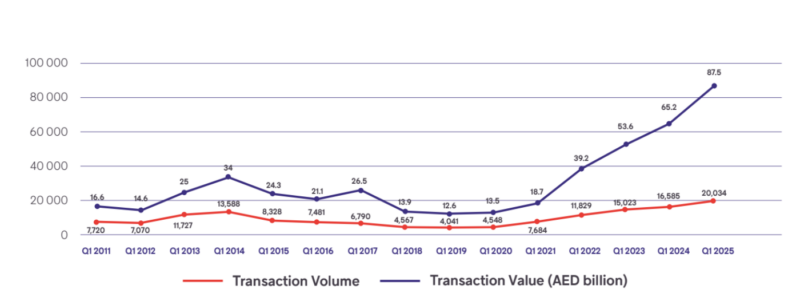

Ready Sales Transactions

- Dubai’s ready property segment also set a new record in Q1 2025, achieving its highest quarterly performance in over a decade.

- The ready segment recorded approximately 20,034 transactions in Q1 2025, marking a 21% year-on-year increase and contributing 44% to the total sales transaction volume.

- Total transaction value surged 34% to AED 87.5 bn, up from AED 65.3 bn in Q1 2024.

- This record-breaking performance exceeded the 2024 quarterly average, with ready market segment volume up 12% and value up 19%.

- These results reaffirm the continued strength and positive momentum of Dubai’s real estate market in 2025.

Historical Ready Transactions Performance

For deeper insights and a comprehensive view of the trends shaping Q1 2025, explore the full Market Watch Digest Report below

Disclaimer: Market Watch Digest serves as a streamlined version of the comprehensive Market Watch report, available in the coming weeks, designed to provide a rapid snapshot of market performance over a specific period.