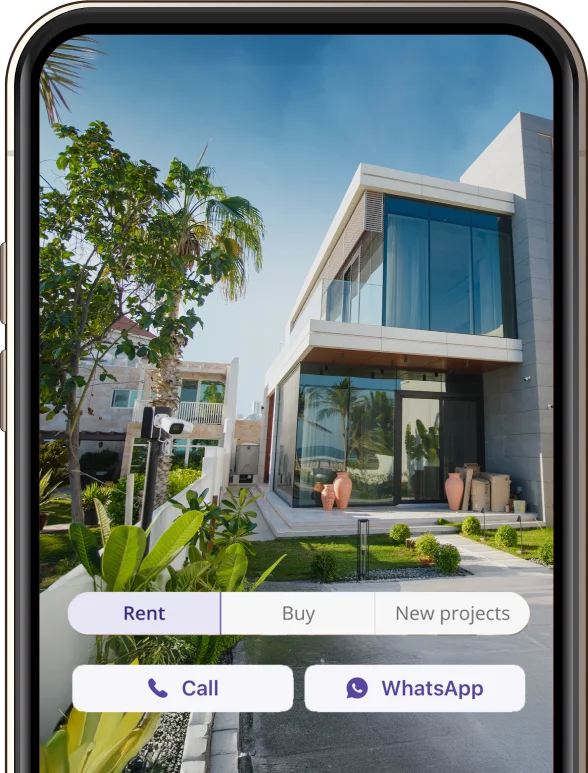

A Home for Every life

Whether you dream to live near a golf course or have the beach within easy reach – Property Finder has a home for every lifestyle.

17 Apr 2025

1 min read

Top Stories

Home Rental in Dubai: All Documents Needed to Lease a Property

Home rental in Dubai is the most common residency option; consequently, if you’re planning to rent a unit in this...

30 Apr 2025

9 min read

Factors to Consider When Buying a Home in Dubai

Are you planning to buy a home in Dubai? If yes, then there are some points you should consider while...

23 Apr 2025

6 min read

All About Property Developers in Dubai

Due to the best property developers in Dubai, real estate shows aesthetic perfection. Let’s explore more!

20 Mar 2025

7 min read

Where to Live

Explore the best areas to live across the UAE, with in-depth guides to help you find your perfect home.

Dubai is making it easier than ever for first-time home buyers.Launching on 2 July 2025, a new First-Time Home Buyer Programme led by the Dubai Land Department (DLD) and the Dubai Department of Economy and Tourism (DET) is set to empower the next generation of first-time home buyers. The Programme is a collaborative effort involving Dubai’s...

02 Jul 25

5 min read

With a range of parking options across the area, finding a stress-free parking space at Sharjah International Airport is a breeze.

30 Jun 25

7 min read

Bluewaters Dubai is a premium waterfront island destination that blends the calm of seaside living with the energy of city life, offering a truly elevated lifestyle for residents and visitors alike. Located just off the coast of JBR The Walk, this island destination is known for its vibrant dining, entertainment and leisure attractions. The glass-fronted apartments offer...

30 Jun 25

6 min read

Here’s all about Abu Dhabi taxi service, a convenient and comfortable way to reach your destination.

29 Jun 25

7 min read

Here’s all about the Bangladeshi passport renewal process, from eligibility criteria to requirements.

26 Jun 25

7 min read

Need to renew your Sri Lankan passport while living in the UAE? This detailed guide covers everything.

24 Jun 25

5 min read

Choosing the right home is about more than just location – lifestyle, trust, and long-term value truly transform a space into a place where you belong. Why Choose a Professionally Managed Community?Living in a professionally managed development offers a seamless, secure, and rewarding lifestyle. With standardised rental procedures, digital leasing platforms, and strict adherence to RERA...

23 Jun 25

5 min read

With multiple options across all terminals, finding a convenient parking space at Zayed International (Abu Dhabi) Airport is a breeze.

19 Jun 25

6 min read

With multiple options across all terminals, finding a convenient parking space at Dubai International Airport is a breeze.

18 Jun 25

7 min read

Here’s all about living in Al Khaznah, a family-friendly and affordable residential community in Al Ain.

05 Jul 25

6 min read

Explore living on Al Muneera Island, an ideal area that offers convenience in a serene environment.

05 Jul 25

6 min read

Living in Al Nasserya, Sharjah, means you are at the centre of all amenities. Let's learn more.

05 Jul 25

7 min read

Living in Al Ghubaiba Sharjah means quiet streets, parks nearby, alongside several daily essentials.

05 Jul 25

8 min read

Living in Hoshi Sharjah offers spacious villas within a family-friendly and calm environment. Here are the details.

04 Jul 25

6 min read

Camellia is a family-friendly and secure sub-community in Ajman Uptown with nearby amenities. Here are the details.

04 Jul 25

6 min read

Want to know what life is like in Al Raffa, Dubai? Discover the lifestyle and much more!

03 Jul 25

7 min read

Experience living in Al Manara, a family-friendly residential area in Dubai with luxurious villas and several facilities.

02 Jul 25

6 min read

Palmera in Arabian Ranches is a serene, villa-style community known for its greenery and family-friendly vibe.

30 Jun 25

5 min read

AboutFounded in 2017, TownX Real Estate Development is a real estate developer based in Dubai with a project portfolio valued over AED 4 billion. The company employs a team of 350 people and has delivered more than 967 units to date. It is currently developing 2,125 apartments and has completed 1,036,000 square feet of premium...

01 Jul 25

6 min read

Burj Azizi is a mixed-use residential, retail and hotel development—here's more on it.

23 Jun 25

7 min read

Ramhan is a heavenly island in Abu Dhabi. It is naturally shaped and offers all the charm of nature and waterfront living.

30 May 25

8 min read

Get ready for a gaming universe in Abu Dhabi — here's all we know about the world’s first e-Sports Island.

30 May 25

5 min read

The world’s tallest resort is under construction – Therme Dubai will be opening in 2028!

30 May 25

5 min read

Invest in Siniya Island — a talk of the town development in Umm Al Quwain. Here's more on it.

30 May 25

5 min read

AboutPalma Development began its journey in 2002 as one of the pioneering private real estate developers in Dubai. Fast forward to 2025, and Palma Development has completed 15 premium projects, covering over 8 million square feet across Dubai’s most sought-after locations, including Palm Jumeirah and Dubai Marina, with a total value exceeding AED 16 billion...

27 May 25

6 min read

Las Vegas-inspired island is officially coming to Dubai — here is what you can expect.

23 May 25

6 min read

AboutSobha Realty is an international luxury developer committed to redefining the art of living through sustainable communities. Established in 1976 as an interior decoration firm in Oman by PNC Menon, a visionary entrepreneur, the company has grown its presence with developments and investments in the UAE, Oman, Bahrain, Brunei and India. To date, Sobha has...

14 May 25

6 min read

Here’s all you need to know about Canadian passport renewal in Dubai, from eligibility criteria to procedure

17 Jun 25

6 min read

Planning to travel to China as a UAE resident? Learn the complete details about the visa application

13 Jun 25

8 min read

Get your Philippine passport renewed in Dubai in simple steps. Here is more on it.

06 Jun 25

8 min read

Want to generate passive income in RAK? Here's how to turn your house into a holiday home.

04 Jun 25

8 min read

REITs in Dubai have made property investments convenient and accessible. Let's learn more.

04 Jun 25

8 min read

DLD offers a lease to own transfer service in Dubai between the owner and the financing entity.

04 Jun 25

5 min read

Let’s find out everything about second mortgages on one property in the UAE.

26 May 25

6 min read

Start your teaching career with a teacher licence in the UAE. Here's more on it.

24 May 25

9 min read

A Memorandum of Association (MOA) is a legal document required for company formation. Here is more on it.

07 May 25

5 min read

Plan a fun-filled summer getaway in Dubai — here's your complete guide.

05 Jul 25

8 min read

Curiosity Lab - A space for curious kids to explore science through fun workshops, camps and hands-on learning.

05 Jul 25

7 min read

Here’s all about Al Buqaish Private Zoo, an educational and exciting spot in Kabir to witness wildlife.

04 Jul 25

6 min read

Designed as a palm tree, Nakheel Park in Dubai reflects a true desert heritage of the UAE.

04 Jul 25

7 min read

Located in Dubai Festival City Mall, Bounce X is the world's first freestyle terrain park.

04 Jul 25

7 min read

Various fitness centres offer the best swimming classes in Ajman. Let’s discover where to enrol.

04 Jul 25

5 min read

Flipped Park Sharjah is an indoor playground offering a variety of activities for kids. Here are the details.

03 Jul 25

5 min read

Kalba Beach is a natural gem on the Gulf of Oman, stretching between Sharjah and Fujairah.

03 Jul 25

7 min read

The 24-hour gyms in Dubai provide excellent facilities and equipment to work out at flexible hours. Here are the details.

03 Jul 25

8 min read

Grand Mall Ajman offers a convenient mixture of shopping, casual dining and essential services. Here’s more.

05 Jul 25

4 min read

Al Dana Centre is a well-maintained business and shopping hub offering essential services, restaurants and offices.

03 Jul 25

6 min read

Discover shops, dining and fun entertainment options for kids and adults alike at Al Mafraq Mall, Abu Dhabi.

29 Jun 25

6 min read

Al Khawaneej Mall is a brand new shopping destination in Dubai. Here's what we know so far.

23 Jun 25

5 min read

The Pavilion International City is a convenient mall that offers everything from clinics to restaurants, play areas and hypermarkets.

22 Jun 25

5 min read

Discover a variety of everyday shops, cosy cafes and convenient services at My City Centre Al Barsha

20 Jun 25

6 min read

Planning a visit to Grand Centrale in Ajman? Here’s your complete guide.

20 Jun 25

5 min read

Sharjah City Centre shops offer a range of products from daily essentials to electronics and more. Here are the details.

19 Jun 25

7 min read

Let’s explore Mudon Community Centre, an all-in-one mall where you can shop, dine, work out and more!

18 Jun 25

5 min read

Start your search for your

dream home with Property Finder

Podcasts

Subscribe to Our Newsletter

Download the UAE’s most trusted property search app

Install the Property Finder app and start searching smarter.