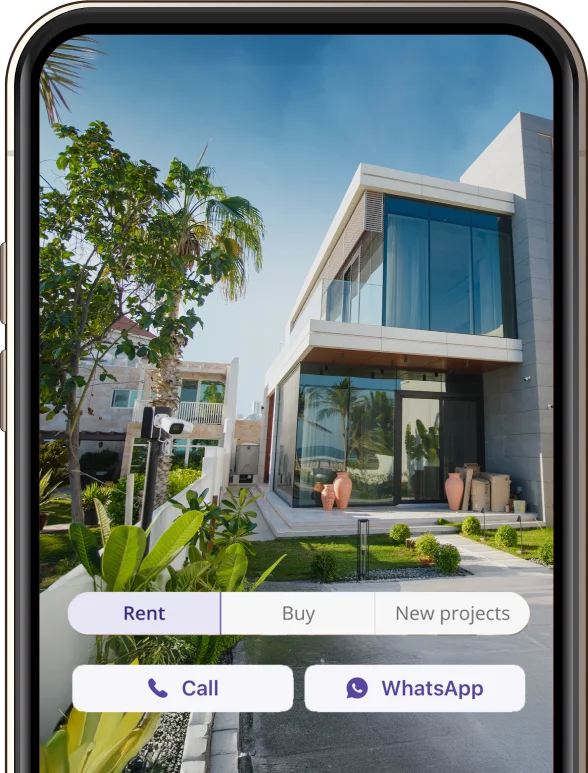

A Home for Every life

Whether you dream to live near a golf course or have the beach within easy reach – Property Finder has a home for every lifestyle.

17 Apr 2025

1 min read

Top Stories

First-Time Home Buyers To Benefit From New Programme Providing Opportunities To Purchase Properties In Dubai

Dubai is making it easier than ever for first-time home buyers.Launching on 2 July 2025, a new First-Time Home Buyer...

2 Jul 2025

5 min read

Comparison of Service Charges for Apartments Vs Villas in Dubai

Apartments vs villas - let's compare the service charges of the most popular communities in Dubai.

23 Apr 2025

7 min read

On the Rise: Monthly Developer Spotlight on TownX

AboutFounded in 2017, TownX Real Estate Development is a real estate developer based in Dubai with a project portfolio valued...

1 Jul 2025

6 min read

Where to Live

Explore the best areas to live across the UAE, with in-depth guides to help you find your perfect home.

Travel conveniently by taking the Red Line from the UAE Exchange Metro Station. Let’s discuss more

13 Jul 25

5 min read

Yas Express offers several intercity and intra-city routes, providing free rides to Yas Island. Here's more.

13 Jul 25

7 min read

Learn how Fawri services speed up your Emirates ID in just 24 hours. Check costs, centres and steps to get your card fast across the UAE.

12 Jul 25

7 min read

ICP Smart Services has simplified visa issuance, passport renewals and checking visa status. Here's more.

11 Jul 25

10 min read

Your go-to guide for school admissions in Dubai, age criteria, KHDA rules and how to apply.

09 Jul 25

6 min read

Dubai is making it easier than ever for first-time home buyers.Launching on 2 July 2025, a new First-Time Home Buyer Programme led by the Dubai Land Department (DLD) and the Dubai Department of Economy and Tourism (DET) is set to empower the next generation of first-time home buyers. The Programme is a collaborative effort involving Dubai’s...

02 Jul 25

5 min read

With a range of parking options across the area, finding a stress-free parking space at Sharjah International Airport is a breeze.

30 Jun 25

7 min read

Bluewaters Dubai is a premium waterfront island destination that blends the calm of seaside living with the energy of city life, offering a truly elevated lifestyle for residents and visitors alike. Located just off the coast of JBR The Walk, this island destination is known for its vibrant dining, entertainment and leisure attractions. The glass-fronted apartments offer...

30 Jun 25

6 min read

The villa communities in Sharjah offer properties of various sizes with several amenities. Here are the details.

13 Jul 25

6 min read

Bermuda Villas is a vibrant waterfront community in Ras Al Khaimah where work and lifestyle blend in a modern setting.

13 Jul 25

7 min read

Several reputable pest control companies in Ajman offer reliable services and are recommended for their quality service and expertise.

10 Jul 25

6 min read

Learn about the pros and cons of living in Umm Al Quwain’s oasis town, Falaj Al Mualla.

10 Jul 25

6 min read

Several reputable companies offer reliable AC repair services in Dubai, recommended for their quality service and expertise.

09 Jul 25

6 min read

Lead a peaceful lifestyle in one of the best communities in Al Furjan!

08 Jul 25

7 min read

Rent or buy a villa in one of the popular communities in The Meadows and enjoy a tranquil lifestyle.

08 Jul 25

7 min read

Savour bold flavours and creative flair at Dubai Design District's most stylish dining spots.

07 Jul 25

7 min read

You can find a variety of buildings in Al Nahda that offer contemporary amenities. Here are the details.

07 Jul 25

5 min read

AboutFounded in 2017, TownX Real Estate Development is a real estate developer based in Dubai with a project portfolio valued over AED 4 billion. The company employs a team of 350 people and has delivered more than 967 units to date. It is currently developing 2,125 apartments and has completed 1,036,000 square feet of premium...

01 Jul 25

6 min read

Burj Azizi is a mixed-use residential, retail and hotel development—here's more on it.

23 Jun 25

7 min read

Ramhan is a heavenly island in Abu Dhabi. It is naturally shaped and offers all the charm of nature and waterfront living.

30 May 25

8 min read

Get ready for a gaming universe in Abu Dhabi — here's all we know about the world’s first e-Sports Island.

30 May 25

5 min read

The world’s tallest resort is under construction – Therme Dubai will be opening in 2028!

30 May 25

5 min read

Invest in Siniya Island — a talk of the town development in Umm Al Quwain. Here's more on it.

30 May 25

5 min read

AboutPalma Development began its journey in 2002 as one of the pioneering private real estate developers in Dubai. Fast forward to 2025, and Palma Development has completed 15 premium projects, covering over 8 million square feet across Dubai’s most sought-after locations, including Palm Jumeirah and Dubai Marina, with a total value exceeding AED 16 billion...

27 May 25

6 min read

Las Vegas-inspired island is officially coming to Dubai — here is what you can expect.

23 May 25

6 min read

AboutSobha Realty is an international luxury developer committed to redefining the art of living through sustainable communities. Established in 1976 as an interior decoration firm in Oman by PNC Menon, a visionary entrepreneur, the company has grown its presence with developments and investments in the UAE, Oman, Bahrain, Brunei and India. To date, Sobha has...

14 May 25

6 min read

Here’s all you need to know about Canadian passport renewal in Dubai, from eligibility criteria to procedure

17 Jun 25

6 min read

Planning to travel to China as a UAE resident? Learn the complete details about the visa application

13 Jun 25

8 min read

Get your Philippine passport renewed in Dubai in simple steps. Here is more on it.

06 Jun 25

8 min read

Want to generate passive income in RAK? Here's how to turn your house into a holiday home.

04 Jun 25

8 min read

REITs in Dubai have made property investments convenient and accessible. Let's learn more.

04 Jun 25

8 min read

DLD offers a lease to own transfer service in Dubai between the owner and the financing entity.

04 Jun 25

5 min read

Let’s find out everything about second mortgages on one property in the UAE.

26 May 25

6 min read

Start your teaching career with a teacher licence in the UAE. Here's more on it.

24 May 25

9 min read

A Memorandum of Association (MOA) is a legal document required for company formation. Here is more on it.

07 May 25

5 min read

Known for mouthwatering and delicious dishes, the restaurants in Al Satwa in Dubai serve the best food in town.

15 Jul 25

8 min read

JVT offers some excellent schools within its community, with more options available just minutes away. Let's explore.

15 Jul 25

7 min read

Looking for a fun way to stay fit in Abu Dhabi? These Zumba classes combine dance, cardio and energy for the perfect workout experience.

14 Jul 25

7 min read

Known for mouthwatering and delicious dishes, the restaurants in Dubai Creek Harbour serve the best food in town.

14 Jul 25

7 min read

Stay at a premium hotel in JVT and make the most of your Dubai trip — let's find out more.

14 Jul 25

11 min read

The Pilates centres in Dubai are led by a team of international instructors from reputable Pilates and Yoga schools worldwide.

14 Jul 25

7 min read

With years of experience, the nurseries in Deira Dubai have built an excellent reputation for creative teaching methods and love for children.

14 Jul 25

8 min read

Looking for urgent medical assistance or a routine check-up? Learn about the best clinics in DIP.

14 Jul 25

9 min read

Explore schools in Shabiya with good ADEK ratings and top curriculum options.

14 Jul 25

10 min read

Explore the best shops in Al Jimi Mall, Al Ain. Enjoy top brands, tasty dining and family-friendly fun in one vibrant shopping spot.

12 Jul 25

10 min read

Meadows Souk is a cosy community mall with diverse dining options, a supermarket, beauty salons and gyms.

11 Jul 25

4 min read

Discover top shops at Ibn Battuta Mall Dubai — fashion, food, fun and more under one roof!

11 Jul 25

11 min read

Explore top shops in BurJuman Mall, from fashion to electronics and much more for an unforgettable shopping experience.

11 Jul 25

6 min read

Located in Jebel Ali, Crown Mall is a community-friendly retail hub perfect for convenient and budget-friendly shopping.

10 Jul 25

5 min read

XPO Mall LLC in Jebel Ali Industrial Area is a convenient shopping centre designed for everyday needs.

09 Jul 25

5 min read

Let’s discover some of the well-stocked supermarkets in Ras Al Khaimah near you!

09 Jul 25

7 min read

J3 Mall features a variety of stores and dining spots to offer a perfect shopping experience. Here are the details.

06 Jul 25

6 min read

Planning a visit to Aswaaq Mall Nad Al Sheba? Here’s your ultimate guide to this shopping spot!

06 Jul 25

4 min read

Start your search for your

dream home with Property Finder

Podcasts

Subscribe to Our Newsletter

Download the UAE’s most trusted property search app

Install the Property Finder app and start searching smarter.