A credit score is a three-digit number indicating your ability to pay debts. Your credit score plays a significant role in getting a new credit card, car loan or personal loan.

Moreover, because it impacts your eligibility for a mortgage, it is especially critical if you are looking into buying a home in Dubai.

In this article, we’ll explain what a credit score is and why it’s so important. We’ll also throw in some valuable tips on how to boost your credit score. So, let’s get started!

- What is a credit score?

- How is your credit score calculated in Dubai?

- What is a good credit score in Dubai?

- How can you check your credit score in Dubai?

- What’s the ideal frequency for checking your credit score?

- How can you improve your credit in Dubai?

- What should you do if there is an error in your credit score?

- What is a credit utilization ratio?

- Minimum credit score for a loan

- FAQs

1. What Is a Credit Score?

Your credit score is a three-digit number between 300 to 900. Is it essentially a metric that banks and lenders use to predict how likely you are to pay your debts on time.

Your credit score is based on a collection of data from any banks or organisations where you have an account or credit within the UAE.

Your credit report will include:

- Credit limits

- Outstanding payments

- Your payment history, including any missed payments and returned cheques.

Why does your credit score matter?

Having a high credit score is a key indicator that you have a good track record of repaying any loans, which makes banks more likely to lend to you. A healthy credit score is critical for getting a mortgage, car loan, personal loan or credit card.

On the other hand, a low credit score positions you as a “high-risk” borrower. Thus banks are less likely to approve loans to you.

2. How Is Your Credit Score Calculated in Dubai?

Credit scoring in the UAE is calculated in a very similar way globally. While there are slight variations, nonetheless it is an assessment of past creditworthiness and potential future risk of non-payment. The score is calculated based on your payment history on liabilities.

In Dubai, Al Etihad Credit Bureau (AECB) is responsible for issuing credit reports and credit scores.

The AECB collects information on your credit history, including:

- Credit cards

- Phone bill

- Mortgage instalments

- Loans etc.

The AECB compiles this information and uses an algorithm to forecast the person’s chance of missing payments during the coming 12 months. The forecast is presented as a credit score, a three-digit number.

Some of the things that impact your credit score can include:

- Do you pay your debts on time?

- Do you pay in full?

- Have there been any returned cheques?

Note that your credit score is not set in stone, and it can increase or decrease according to your financial behaviour.

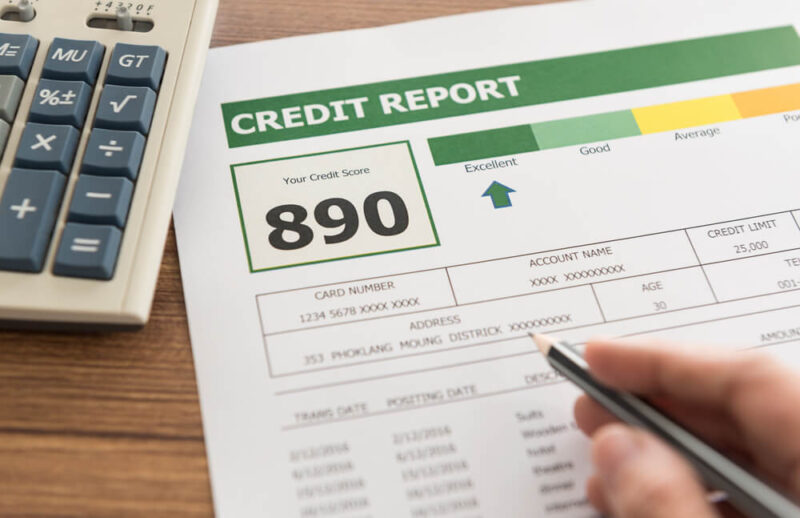

3. What Is a Good Credit Score in Dubai?

In the UAE, a credit score above 680 is considered good, according to the Al Etihad Credit Bureau. Meanwhile, a credit score below 620 is considered to be bad, and it would be challenging to qualify for loans with such a score.

Check the table below to see where your credit score stands:

| Credit Score | Credit Score Rating |

| Above 731 | Excellent |

| 680 – 730 | Good |

| 620 – 679 | Fair |

| 300 – 619 | Bad |

To get a mortgage for example, you would need a credit score of between 650 to 700.

Note that different lenders may require different credit scores based on their credit criteria and the type of credit you are applying for. That’s why you should ask about what the credit credit criteria is when you are looking into different lenders.

4. How Can You Check Your Credit Score in Dubai?

To check your credit score in the UAE, visit the official website of the Al Etihad Credit Bureau (AECB). Alternatively, you can use AECB’s mobile app. It currently costs AED 84 to download your credit report.

5. What Is the Ideal Frequency for Checking Your Credit Score?

Generally, a good rule of thumb would be to check your credit score every year.

Tips to Consider

- Check your credit score before applying for any loans or credit cards to ensure you are aware of any potential issues.

- It is also a good idea to check your score a few months in advance so that you have a chance to address any issues that are lowering it.

6. How Can You Improve Your Credit Score in Dubai?

The easiest and most straightforward way to improve your credit score is to pay your bills on time and reduce any credit you have.

Additionally, avoid these common mistakes that lead to a lower credit score:

- Missing or making delayed payments

- Letting cheques bounce

- Having several lines of credit

- Using all your limits on credit cards.

7. What Should You Do if There Is an Error in Your Credit Score?

This would depend on what the error is:

- If you have cleared a line of credit, but it is still showing up as outstanding on your credit report, you need to take this up with the concerned bank to correct the issue.

- If there are entries on the report that just do not relate to you, you need to reach out to the relevant data provider to remove the incorrect information.

Before you apply for a mortgage, we would recommend discussing your credit report with one of Mortgage Finder’s advisors. With their help, you can ensure that your credit report is accurate, giving you the best chance of getting your mortgage application approved.

8. What Is a Credit Utilisation Ratio?

A credit utilisation ratio is the percentage of the credit used from the total credit available to you.

Credit Utilisation Ratio = Credit UsedTotal Credit Available 100

This ratio can impact your credit score, and a higher score will lower your credit score. That is because a higher credit utilisation ratio can indicate a strain on your cash flow, meaning you could be at higher risk for defaulting on payments.

To maintain a healthy credit utilisation ratio, you can either reduce your debt or, if appropriate, increase your credit limits without increasing your debt.

9. What is the Minimum Credit Score for a Loan in the UAE?

You need a credit score of at least 580 to qualify for a personal loan in the United Arab Emirates. While 580 is the minimum score, you should note that higher credit scores often unlock better interest rates and more favourable loan terms. Therefore, maintaining a good credit score is not only essential for loan approval but also for securing better loan conditions.

FAQs

In the UAE, financial institutions generally regard a credit score ranging from 650 to 710 as average. This score is a key factor for lenders across the board, whether you’re applying for an automobile loan, home loan, or a credit card, highlighting its importance in the assessment process for various financial products.

In the UAE, where credit scores span from 300 to 900, a score of 750 is considered very good. Moreover, Scores within the range of 680 to 730 are deemed good as we mentioned before in the article, while scores of 731 and higher are classified as excellent, reflecting an exceptional level of credit health.

Yes, checking your credit score in the UAE is possible through the AECB App. Here’s how to do it:

This brings our guide on credit scores in the UAE to a close. Armed with this information, you can be confident in managing your credit and maintaining a healthy credit score, unlocking the doors to car loans and mortgages and much more.

If you’re looking to secure a mortgage in the UAE, there is no better place to start than Mortgage Finder. With their mortgage experts, they can help you find the best mortgage for you.

The process might seem a little exhausting but once you find how beautiful your new house will turn out, you will forget all about these steps.

Author

Julie Symons – Head of Loan Progression, Mortgage Finder