The United Arab Emirates maintains its status as a global investment hub, where real estate plays an important role in its growth and diversification.

The UAE continues to offer reliable opportunities and reinforces its status as a leading global real estate market, thanks to its strong economic fundamentals and progressive regulations.

This report looks into the investment trends shaping the UAE property market in 2025, focusing on performance, investor behavior, and emerging opportunities.

- Executive Summary

- Market Performance

- Investment Opportunities

- Price Appreciation Leaders

- Investor Profiles

- Supply Pipeline and Market Forecast

- Strategic Investment Recommendations

- Portfolio Diversification Strategy

- Key Takeaways

- Navigating the Next Chapter of Growth

Executive Summary

Here’s a look at the key data and insights guiding the next wave of real estate investment across the UAE:

- Dubai’s property market set new transaction records in the second quarter of 2025 with 53,252 sales worth AED 184.3 billion.

- A total of 98,726 transactions worth AED 327 billion in value were completed in the first half of this year.

- The average rental yield was 7.4%, peaking at 9.4% in affordable communities.

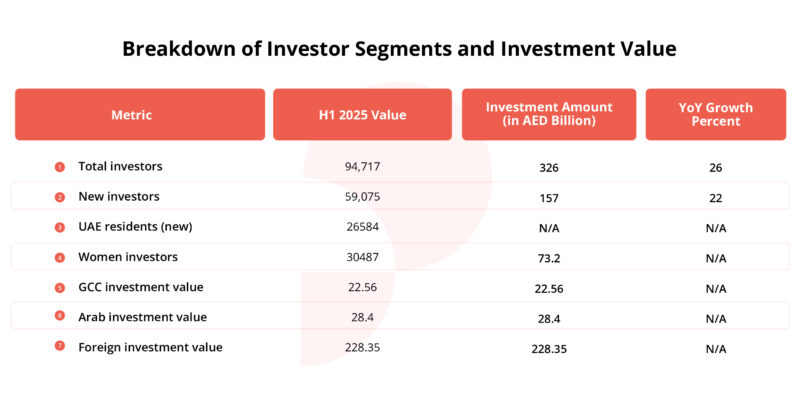

- 94,717 investors, led by foreign buyers, invested a total of AED 326 billion in properties for sale in the UAE in H1 2025.

- A supply surge of 240,000 units from 2025 to 2027 will shift market dynamics and create strategic buying opportunities through 2026.

Market Performance

The UAE property market continued to demonstrate its strength in 2025, with Dubai leading an exceptional first half of the year.

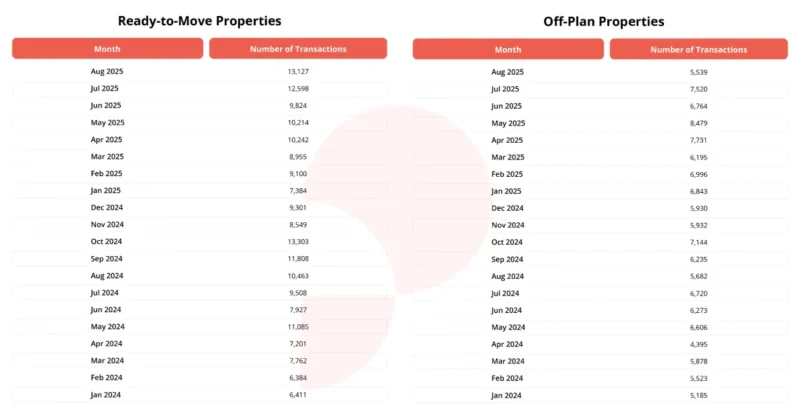

Dubai recorded its strongest ever quarterly performance in Q2 of this year. In Q1 2025, 45,474 transactions worth AED 142.7 billion were posted. Moreover, there was a 22% increase in volume and a 49% surge in value year-on-year for its properties for sale.

The monthly volume average was pegged at 17,143, with ready properties accounting for 60% of the share.

Much of this growth was driven by strong end-user and investor demand for properties for sale in Dubai.

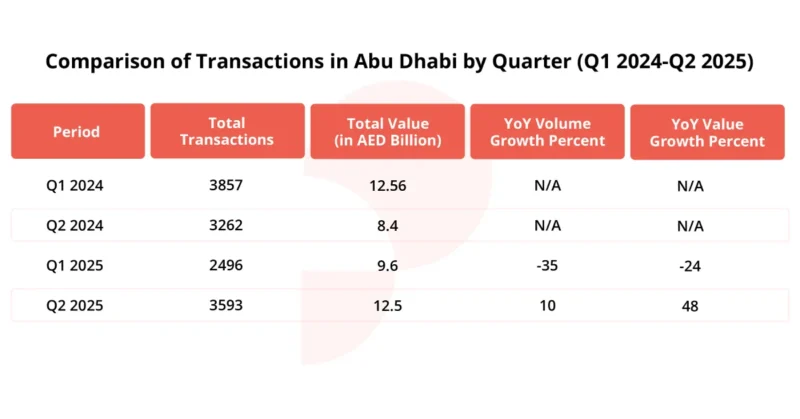

The UAE’s capital city, Abu Dhabi, experienced a quieter start to the year, with a 35% decrease in Q1 volumes. However, it made a strong comeback in the second quarter, posting a 10% increase in transactions and a 48% rise in total value.

These figures reflect a growing demand for ready properties for sale in Abu Dhabi.

In terms of overall transaction volume, current activity remains at 90% of peak, showing a stronger seller’s market. This is significantly higher than the figures posted in October 2024, which peaked at 20,447 sales.

Based on the data, both markets show an active, developing property sector. The country is experiencing a rebalanced, more progressive investment landscape, where both Dubai and Abu Dhabi are finding their footing in continuous growth.

Investment Opportunities

The UAE property market continues to offer attractive investment opportunities across a variety of communities. High-yield areas are performing strongly, particularly in affordable neighborhoods that balance entry-level pricing with steady rental income.

Here’s a look at the trends:

Top Rental Yields in Dubai

The areas with the highest gross or net rental yields in Dubai are:

Communities with affordable properties (starting at AED 1,500/sq ft) deliver yields of over 7.5%.

Capital Appreciation Opportunities

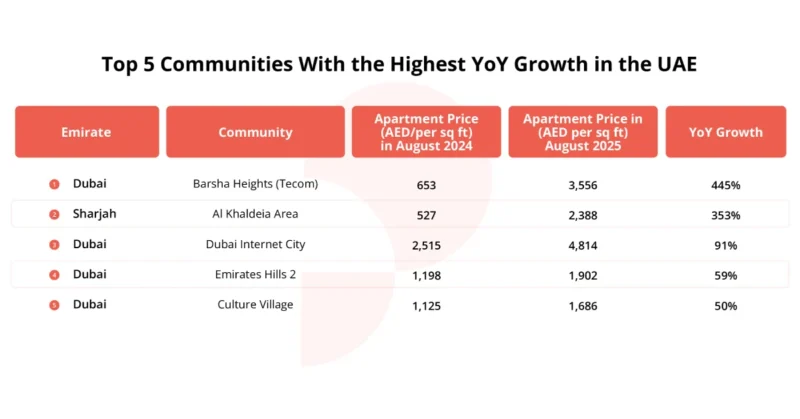

Barsha Heights (Tecom), Dubai Internet City, and Emirates Hills 2 posted the highest capital appreciation opportunities YoY.

Geographic Investment Mapping

These are the top three areas where investment activity was concentrated:

Prime High-Yield Opportunities

The areas with the highest average rental yields offering strong returns are:

Top 5 Areas in Dubai With the Highest Rental Yields

| Area | Average Rental Yield | Remarks |

| Dubai Investment Park | 9.44% | Currently the highest in the market |

| International City | 9.10% | Most affordable entry at AED 725/sq ft |

| Arjan | 7.90% | An emerging off-plan hub |

| Discovery Gardens | 7.77% | An established community gaining momentum |

| Jumeirah Village Circle | 7.59% | A community known for its balanced amenities |

Al Furjan, Business Bay, Dubai Marina, Downtown Dubai, and Palm Jumeirah complete the top 10.

The investment matrix reveals a clear inverse relationship between property prices and rental yields, with communities under AED 1,500/sq ft consistently delivering yields above 7.5%.

This presents strategic opportunities for investors prioritizing cash flow over capital appreciation in the short term.

Price Appreciation Leaders

Property Finder used data from August 2024 to August 2025 to identify price growth opportunities in these areas:

Dubai’s Mohammad Bin Rashid Gardens and Dubai Waterfront, Sharjah’s Sharjah Waterfront City and Al Majaz, and Ras Al Khaimah’s Gateway Residences complete the top 10 communities with high YoY growth.

The surge was primarily driven by redevelopment, tech district expansion, and an increased demand for mixed-use communities.

These areas prove the UAE market’s continued capacity for significant capital appreciation, especially in emerging communities.

Investor Profiles

The UAE’s property market continues to attract a diverse pool of investors, reflecting its global appeal and financial stability. Residents, regional buyers, and international investors seeking long-term opportunities in a secure and transparent market are the top buyers.

The data below explores the composition of today’s investor landscape, highlighting how shifting demographics, growing female participation, and cross-border interest are shaping the next phase of growth in the country’s dynamic property sector.

International buyer confidence remains high, with foreign nationals accounting for 70%+ of investment value.

Supply Pipeline and Market Forecast

Property Finder forecasts indicate a change in transformative supply happening soon.

This 2025, a total of 90,000 new units is expected to be delivered, signifying continued strong growth.

2026 is expected to be the peak delivery year, with 120,000 units to be delivered. The number is likely to decrease to 30,000 new units in 2027 as the market stabilizes.

This 240,000-unit supply wave represents approximately a 20% increase in Dubai’s housing stock, creating significant strategic opportunities for discerning investors.

Strategic Investment Recommendations

Based on the data, Property Finder recommends these investment strategies:

Immediate Term (Q4 2025):

The UAE property market remains a strong seller’s market through the last quarter of 2025, with activities reaching a peak of 90.3%.

The best approach is to act decisively on purchasing property in high-yield communities (those with 9%+ returns) and on off-plan projects. These segments are expected to continue to deliver reliable income potential and long-term growth.

However, the fast-moving nature of the market means buyers will have limited negotiating power on prices and payment terms. Taking a proactive and well-informed approach will help secure the right opportunities before the upcoming increase in property supply begins to balance conditions in 2026.

Short Term (H1 2026)

The first half of 2026 will allow investors to take advantage of a more favorable market dynamic while positioning themselves for future appreciation as the market stabilizes after the peak delivery period.

The property market is expected to shift as new housing supply begins to enter the market and impact prices.

At this time, prices may start to moderate, creating a more balanced environment and better entry points, compared to the seller-driven conditions of 2025. With more choices and greater negotiating power, investors are well-positioned to secure high-quality properties.

Investors are encouraged to purchase property from quality developers and in prime locations during the delivery peak.

Medium Term (H2 2026-2027)

In the second half of 2026 and through 2027, the UAE property market is expected to enter a balanced supply-and-demand phase. Market activity will stabilize, and price movements will likely become more predictable as most of the new housing projects will be delivered.

Investors would do well to focus on properties that offer long-term value in sustainably-growing locations. who think long term and focus on sustainable growth rather than quick returns. The best opportunities will be found in mature communities with strong infrastructure, amenities, and consistent demand.

These areas are recommended as they are likely to maintain steady rental income and long-term value even as the market cools slightly.

As the normalized market conditions will favor strategic investors, this is the perfect time to build or expand one’s property portfolio.

Portfolio Diversification Strategy

Investors aiming to diversify their portfolio in Dubai should focus on properties with high-yield income. Investing in Dubai Investment Park (DIP) and International City, which have 9.44% and 9.10% yields, respectively, is a smart strategy.

It is also worthwhile to consider properties in affordable communities under AED 1,500/sq ft for a lower outlay and better cash flow. For a balanced portfolio and optimal risk return, invest 60% in ready properties and 40% in off-plan projects.

For those focusing on capital appreciation, it is important to consistently monitor emerging areas showing 50%+ price growth, such as Barsha Heights and Culture Village. Off-plan projects in master-planned communities, such as Al Yalayis 1 and Mohammed Bin Rashid Gardens, and luxury segments that maintain value, like Dubai Marina and Business Bay, are also worth considering.

Market Timing

Timing affects the success of property investments in the UAE, so investors should consider the following additional strategies:

- Secure high-conviction properties in Q4 2025 before supply impact.

- Leverage the increased property options in 2026, the expected peak delivery year.

- Focus on post-correction value opportunities in 2027’s more stabilized market.

Key Takeaways

Below is an overview of the major trends and strategic signals identified in this report:

- Dubai set new transactional records in Q2 2025, with off-plan holding a slight volume edge, while ready commands a higher value share.

- Abu Dhabi experienced an early-year slowdown, which was offset by a strong mid-year rebound in ready-home transactions.

- This year’s emerging communities with the highest yields and ROI opportunities are those found outside traditional luxury areas.

- Foreign investors drive the majority of value, but there is also an increase in resident and women investor growth.

- A substantial supply wave in 2026 will create buyer advantages and moderate price growth.

Navigating the Next Chapter of Growth

The data shows a clear story: the UAE remains one of the world’s most rewarding real estate destinations. The next few years will bring more properties, providing more investors with more opportunities to look into.

The opportunities ahead are significant for those ready to invest strategically.